Drillnomics New Features – Aug. 2016 Update

Organizational Licenses:

Drillnomics now supports organizational licensing. Rather than purchasing and maintaining separate accounts for multiple people within a company or team, companies can purchase multiple licenses under a single organization at a discounted price. With this organizational licensing structure, your company will receive unique log ins for up to 3 users per license purchased. Additionally, the organization will have an assigned administrator that will be able to add and delete users from the account as needed. This new structure improves data security and integrity and promotes collaboration between Drillnomics users. For more information on purchasing an organizational license, please contact us!

Integrated Help Tips:

Hover over any question mark icon in the top right corner of most boxes/sections in Drillnomics to see a pop up with information about that field or section, including variable definitions, instructions and recommendations. The pop ups contain much of the same information included in this document for quick help when creating projects.

Project Analysis Date:

This field in the Overview tab allows for projects that are actively maintained and updated to have current economic evaluations. Because the new version of Drillnomics enables users to update production data for wells without recreating the project, there is a need to be able to adjust the analysis date to ensure that future cashflow is being discounted to the desired date. This field can be populated with any date. If the Project Analysis Date is later than the Effective Revenue Start Date of a well in the project, all cashflow between the 2 dates will be undiscounted and included in the total value of the well. Any cashflow after the Project Analysis Date will be discounted back to that date at the selected discount rate.

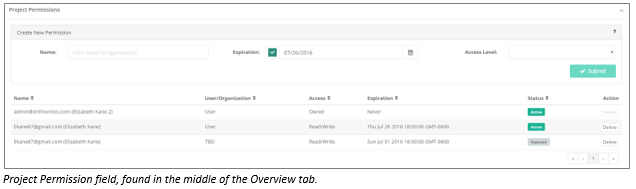

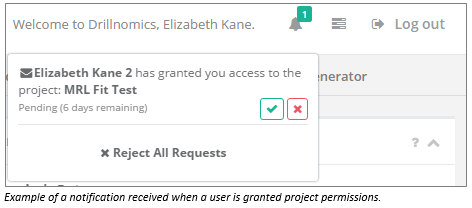

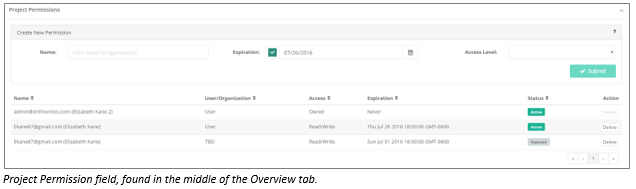

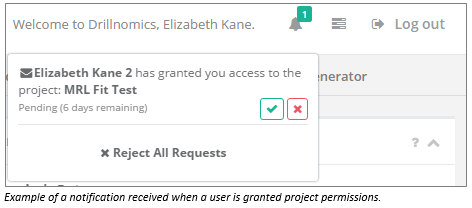

Project Permissions:

This section in the Overview tab allows users to share projects with any other Drillnomics user. Simply type the e-mail address of the user with whom the project is being shared, select an expiration date and access level, and click submit. The available access level options are: read only, read with copy, read/write, and owner. The user being granted permissions will receive a notification, seen in the top right corner of any Drillnomics page (once logged on). That user will have 3 days to accept or reject the permissions, and the permissions will automatically be revoked on the chosen expiration day. If the owner of a shared project deletes the project, all permissions to other users will be revoked. When a project permission is accepted by a user, the project will appear in a folder titled “Shared Projects” in the user’s project list on the left side of the screen.

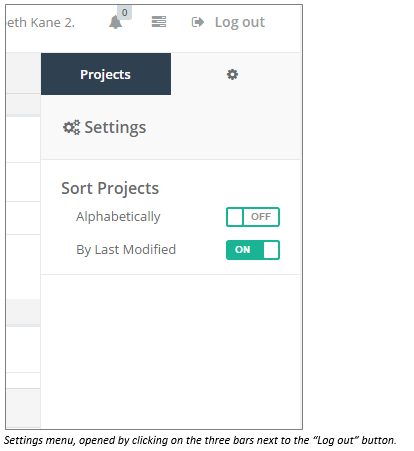

Project Folders and Sorting:

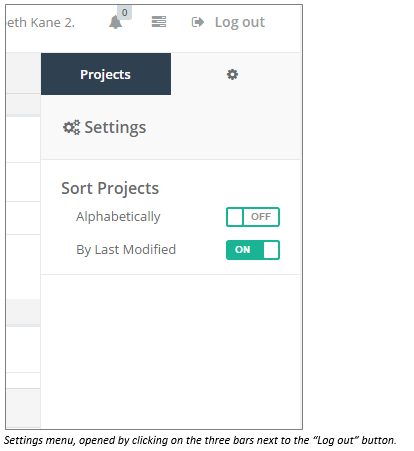

Projects can now be grouped into unique folders in the project list on the left side of the Drillnomics page. When a new project is created, type the desired folder name in the “Folder” field underneath the “Project Name” field on the Overview tab. Drillnomics will automatically place the project into that folder, along with any other projects having the same folder name. Additionally, projects can now be sorted alphabetically or by last modified date (most recent at the top). The sorting option can be changed by clicking on the settings drop down in the top right corner and toggling the desired sorting method “ON”.

Copying Existing Projects:

There is now a button at the bottom of the Overview tab, next to the Delete button, that allows users to create a copy of any project. This will expedite the process of running price, cost, etc. sensitivities and will allow the user to keep a unique copy of each desired scenario.

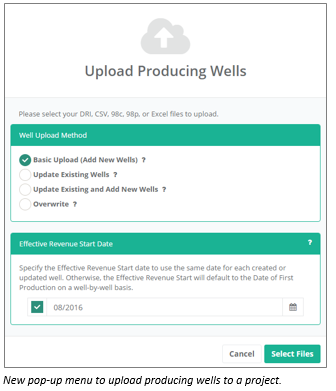

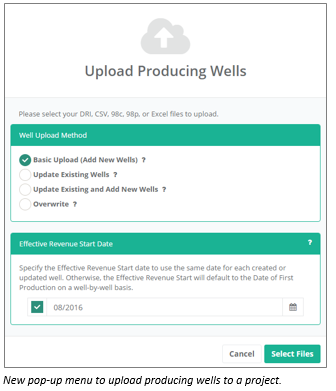

Uploading Wells to a Project:

Wells are added to projects on the Production Analysis tab now (previously done on the Overview tab). The new project structure allows users to upload as many producing and non-producing wells as needed to any project. Previous projects were limited to one type curve per project. There are new options available when uploaded producing data, as well. When a user selects “Upload Producing Wells”, he will be prompted to select a well upload method. There are four options:

- Basic Upload (Add New Wells): A new producing well will be added for each well in the upload file, regardless of whether or not the well already exists in the project

- Update Existing Wells: Updates data for any well in the upload file that has a matching API to a well already existing in the project. No new wells will be added to the project. Use this option to preserve previous production forecasts but update data.

- Update Existing and Add New Wells: Updates production data for any existing well that has a matching API to a well already existing in the project, and creates a new well for any well in the upload file that does not have a matching API in the existing project. No wells will be deleted.

- Overwrite: Updates the project so that all wells in the project match the upload file exactly. Production forecasts for existing wells and type curve wells will be unchanged.

Improved Production and Cashflow Charts (Zoom and Export as an Image Features):

There is now a zoom feature available on the production and cashflow charts. Simply click anywhere on the chart to draw a box around the desired zoom area. The zoom feature will rescale both the x- and y-axes. Once zoomed, a “reset zoom” button will appear in the top right corner of the chart. Click this button to return to the original view. The manual zoom (“Show Months” box for production charts and “Show Years” box for cashflow charts) can still be used as well.

Production and cashflow charts can be printed or exported as an image. Click on the three horizontal lines in the top right corner of any production chart to display available options.

The box that displays when a user hovers over any point on a production or cashflow chart will now display the well name, the production/cashflow value at that point, and the actual month and year of the point.

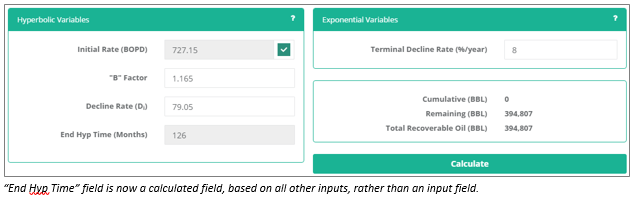

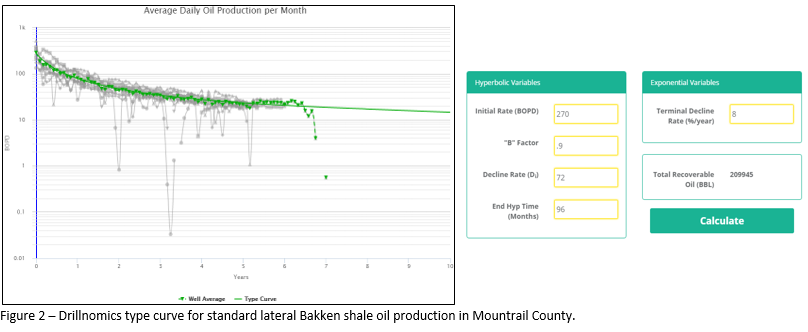

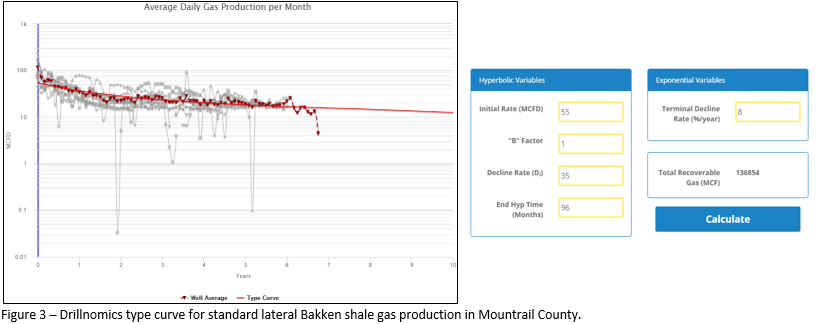

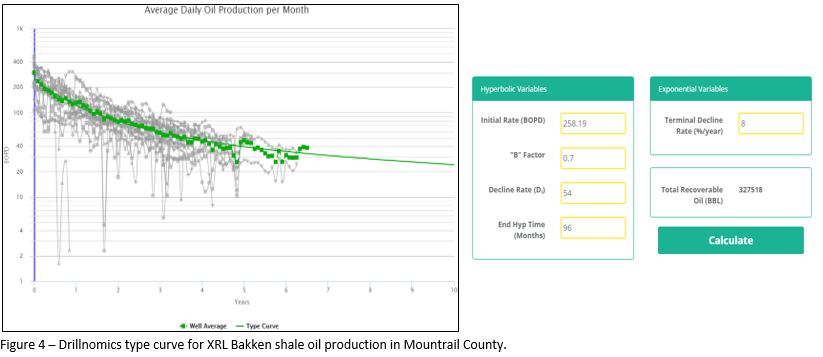

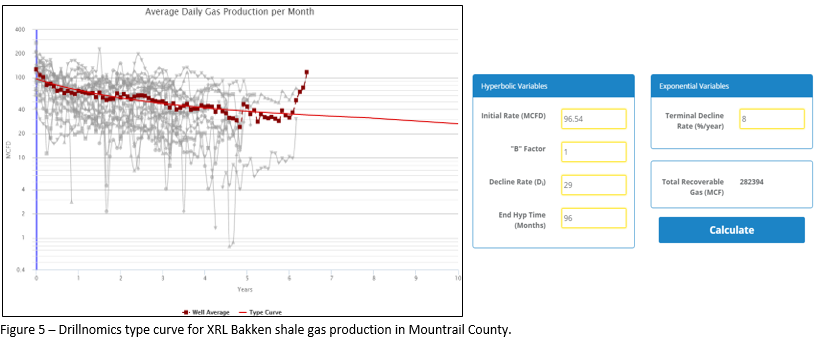

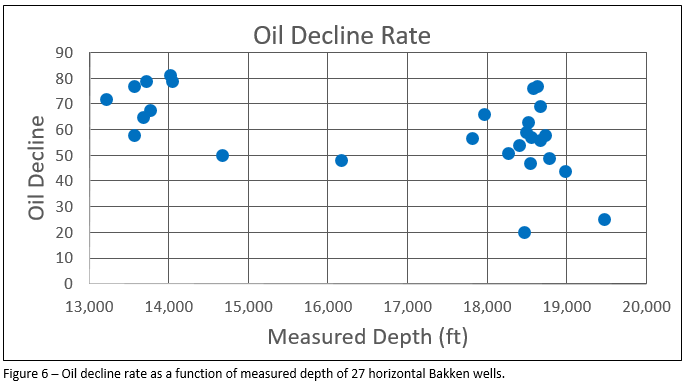

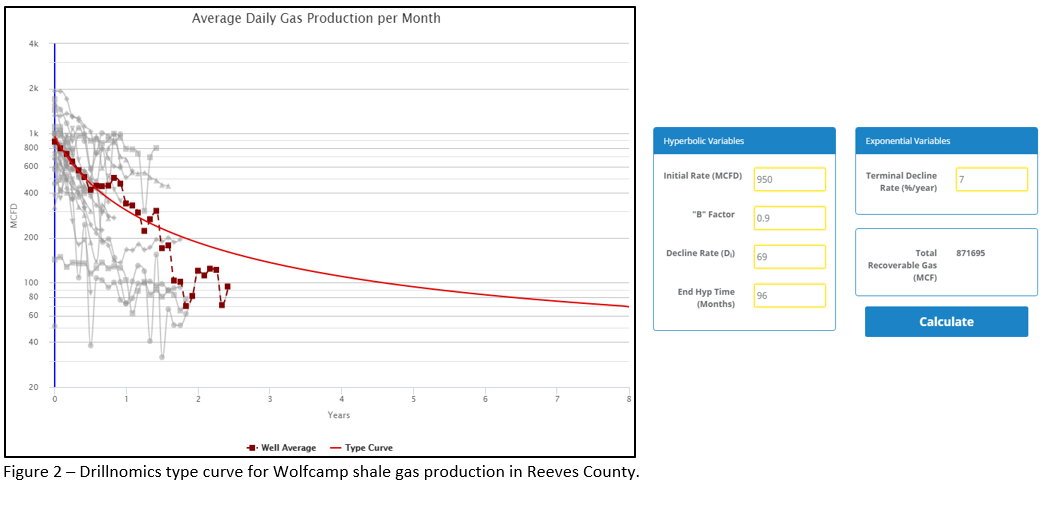

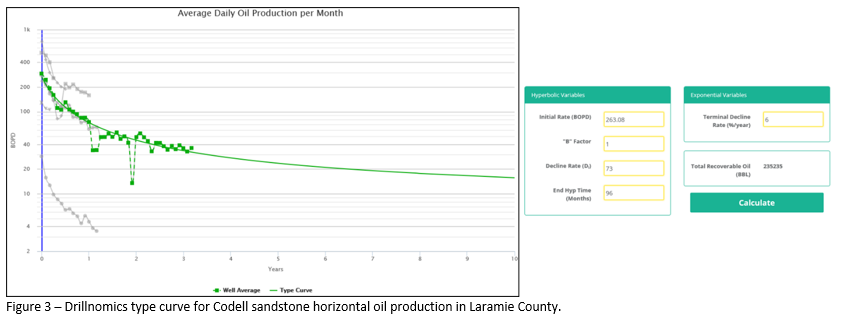

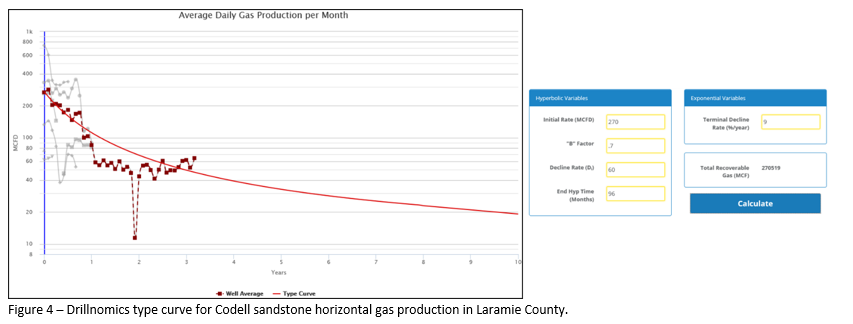

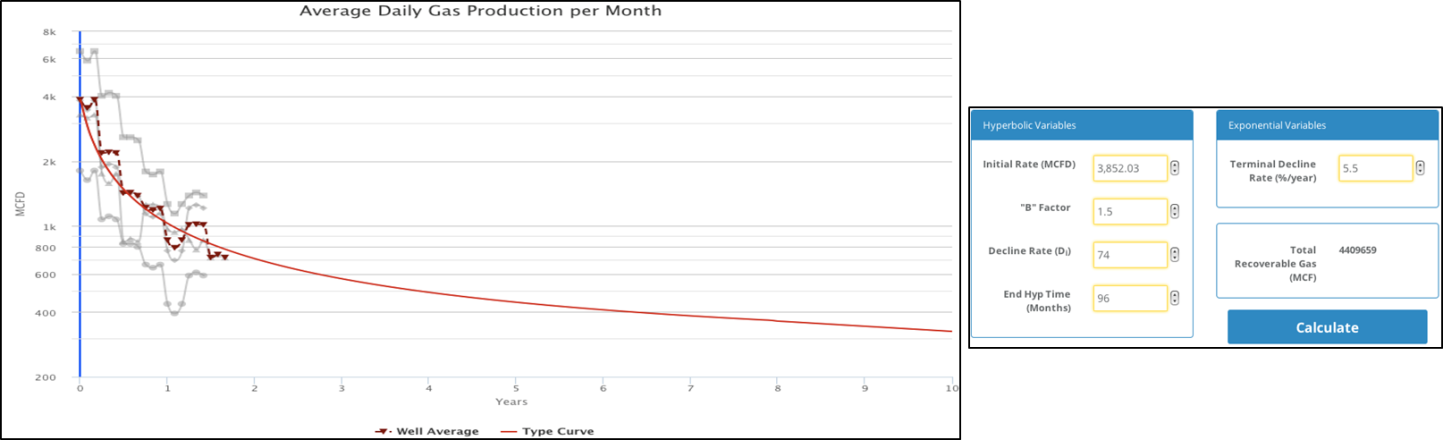

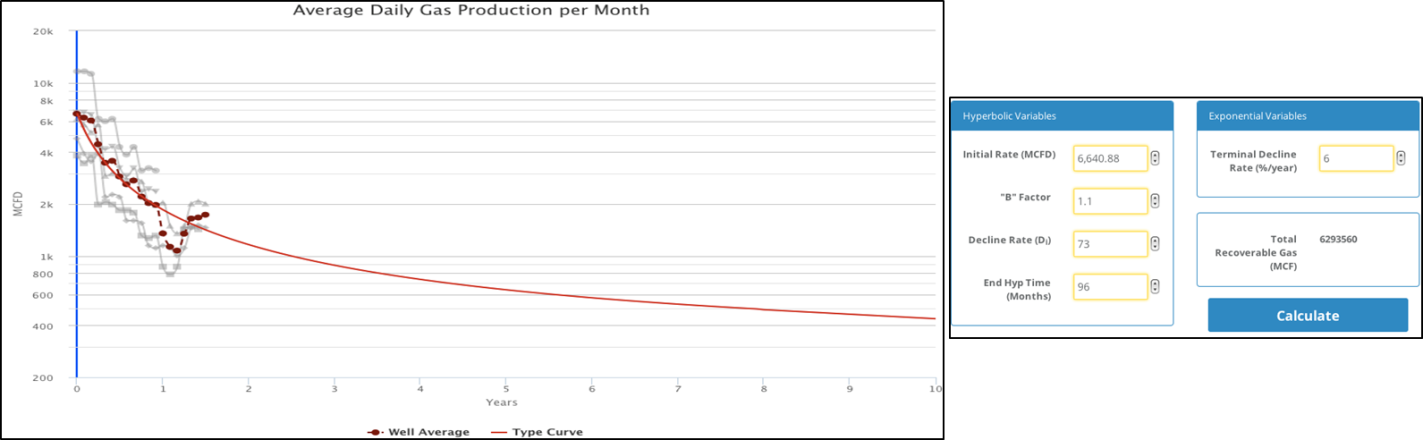

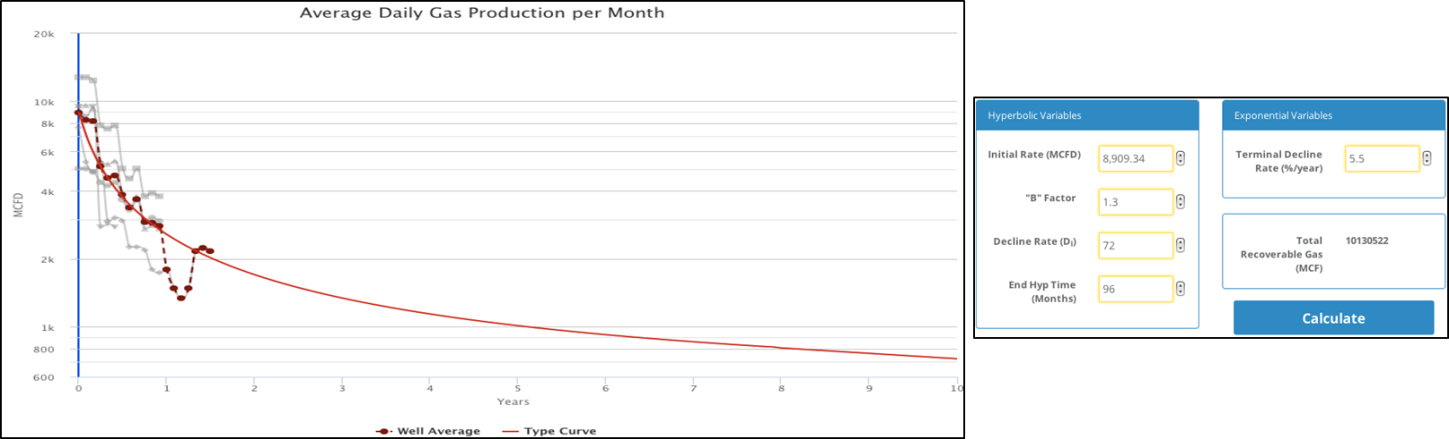

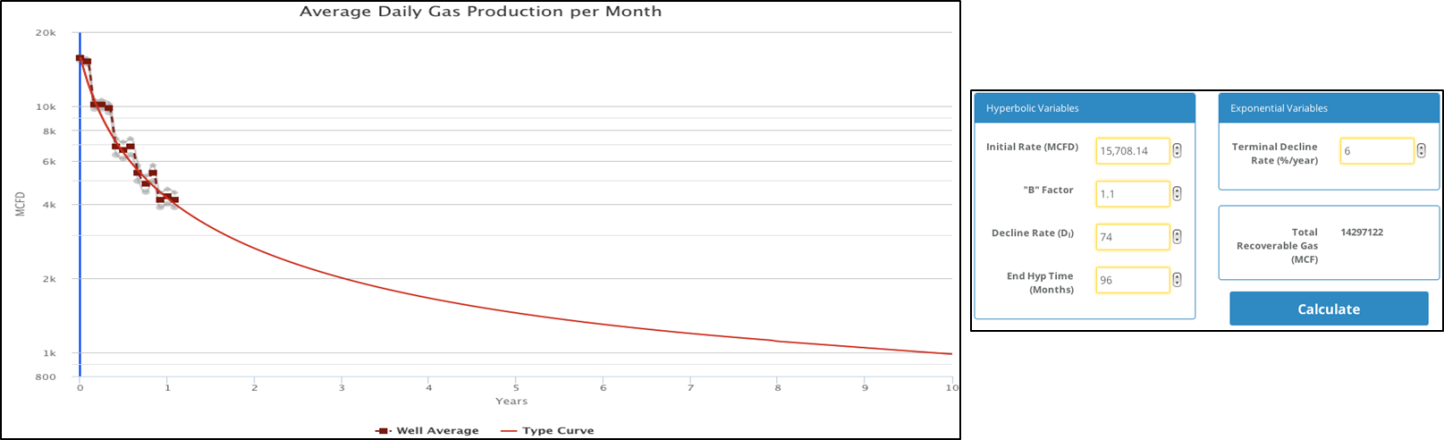

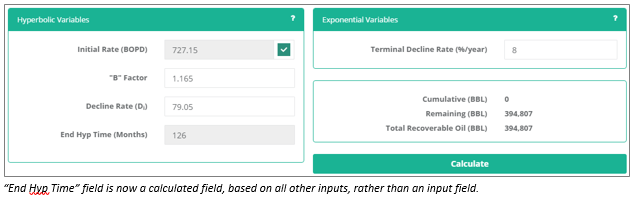

Hyperbolic to Exponential Decline Transition:

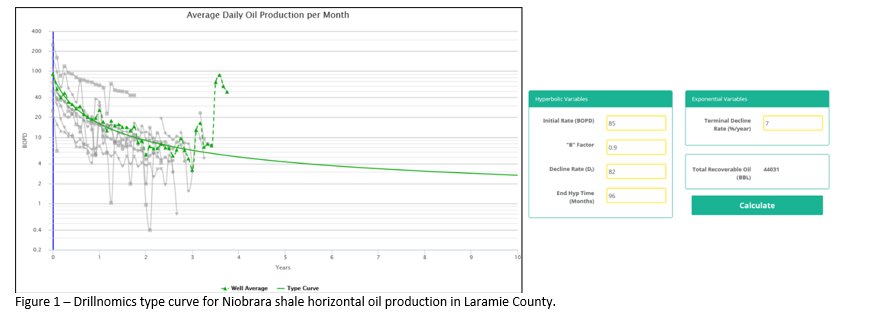

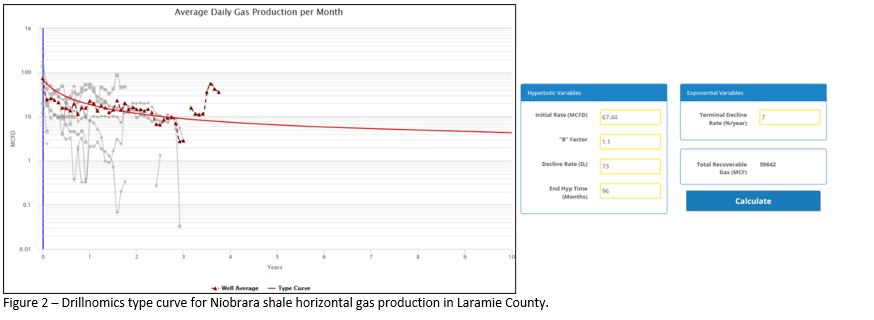

Drillnomics now calculates the date at which the transition from hyperbolic to exponential decline will occur based on the hyperbolic inputs and the terminal decline rate input by the user. The transition will occur at the time when the hyperbolic decline rate equals the specified terminal decline rate.

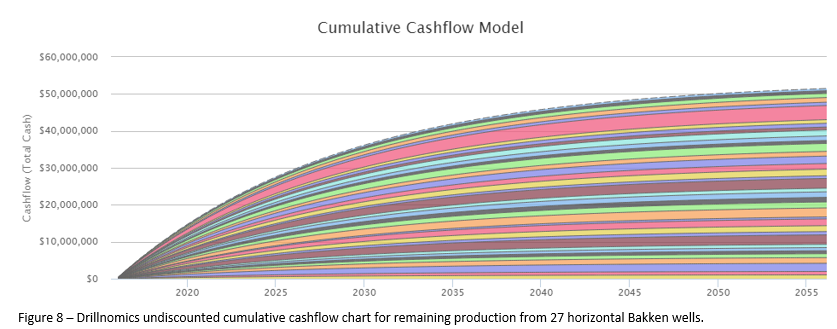

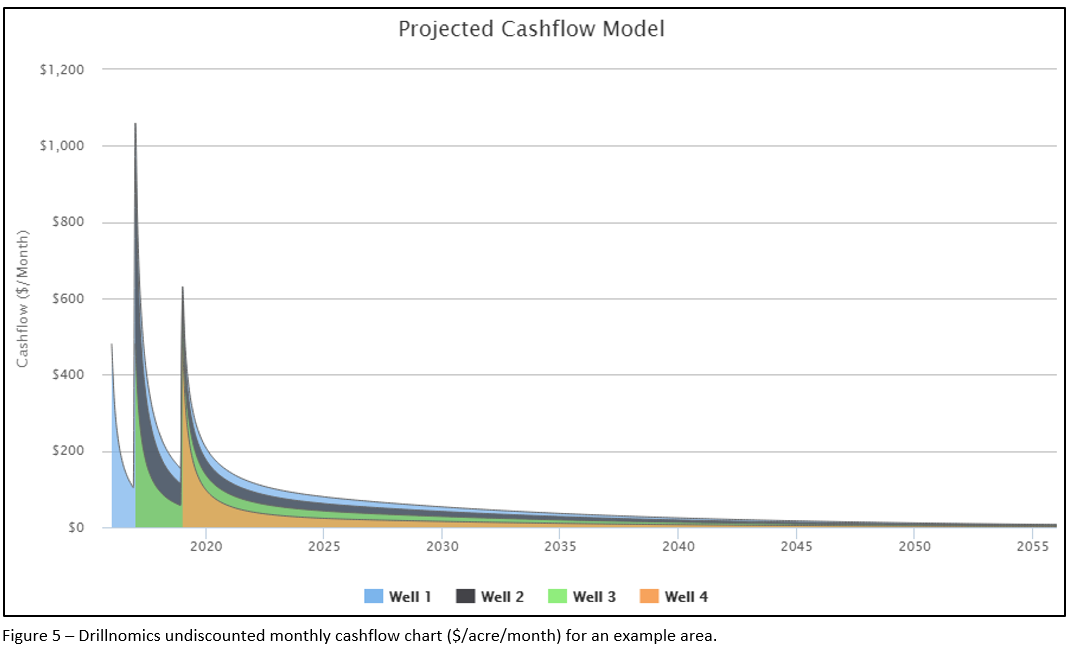

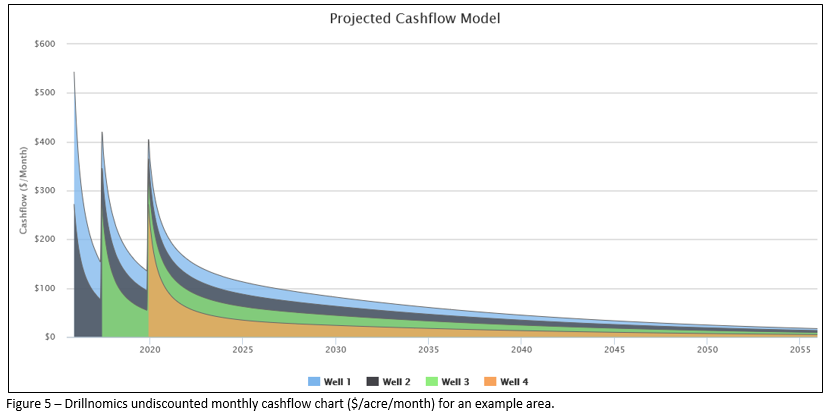

Historical Production Data and EURs:

For producing wells, Drillnomics will use the historical production data for each well when available and the user specified forecast for remainder of the well’s life to calculate cumulative production, remaining reserves, and total recoverable oil/gas (EUR). The cumulative production is the sum of the production from the beginning of the well’s life to the Effective Revenue Start Date, remaining reserves is the sum of the forecasted production from the Effective Revenue Start Date through 99 years of production, and the EUR is the sum of the cumulative production and remaining reserves.

For non-producing (type curve) wells, the cumulative production will always be zero because type curve wells are intended to be representative well profiles used to model economics for future development of an area. Thus, there is no historical production for a type curve and the remaining reserves and EUR will be equal.

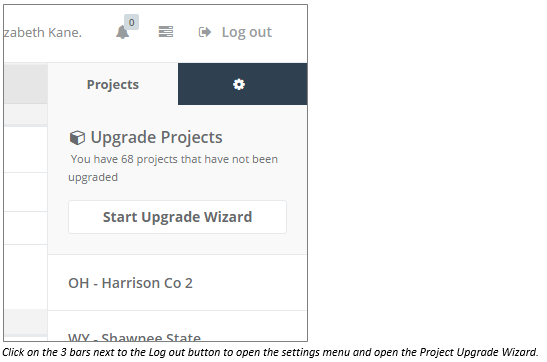

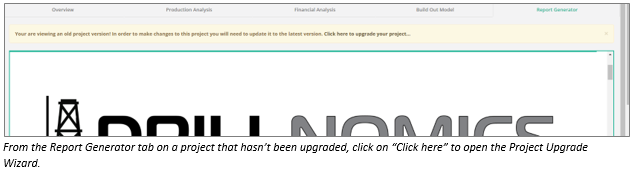

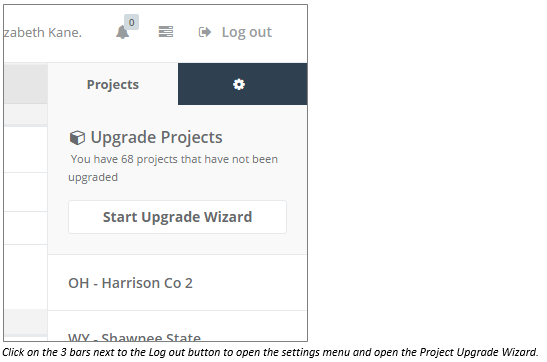

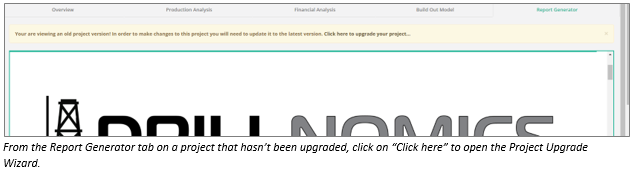

How to Return to the Project Upgrade Wizard after Initial Log In:

If a user chooses not to upgrade all of his projects initially, it is easy to return to the Upgrade Wizard later to upgrade any remaining projects. There are two ways to open the wizard.

- Click on the Settings drop down in the top right corner of the page, then click on the projects tab. There will be a “Start Upgrade Wizard” button and a list of all projects in the account that have not been upgraded.

- When a project that has not been upgraded is opened, the Report Generator tab will open, and that will be the only tab available for that project. At the top of the report, there is a link to click to open the upgrade wizard.

Please contact us (720-307-0106 or admin@drillnomics.com) if you have any questions or feedback about the new features and updates.